Http://www.fullertonmarkets.com is a b-book (money maker) broker, originally based and registered in New Zealand under the name of Fullerton Markets International Limited (FMIL) with their registered address being in Auckland, New Zealand. This is a straight-through processing (STP) broker that offers to trade in currency pairs and CFDs on indices, crude oil, and indices.

Surprisingly, they’ve now come up with an offshore registration of Fullerton Markets International Limited in St. Vincent and the Grenadines (another red flag). Fullerton Markets is an unregulated broker, claiming their company registration number to be their regulatory license number, to confuse the newbies in the market by making it look like a regulated broker.

On the one hand, this forex brokerage claims to be the fastest-growing broker in Asia. On the other hand, their limited customer base confined to only Thailand, Vietnam, and Singapore along with the poor reviews on www.forexpeacearmy.com that speak otherwise about this forex broker.

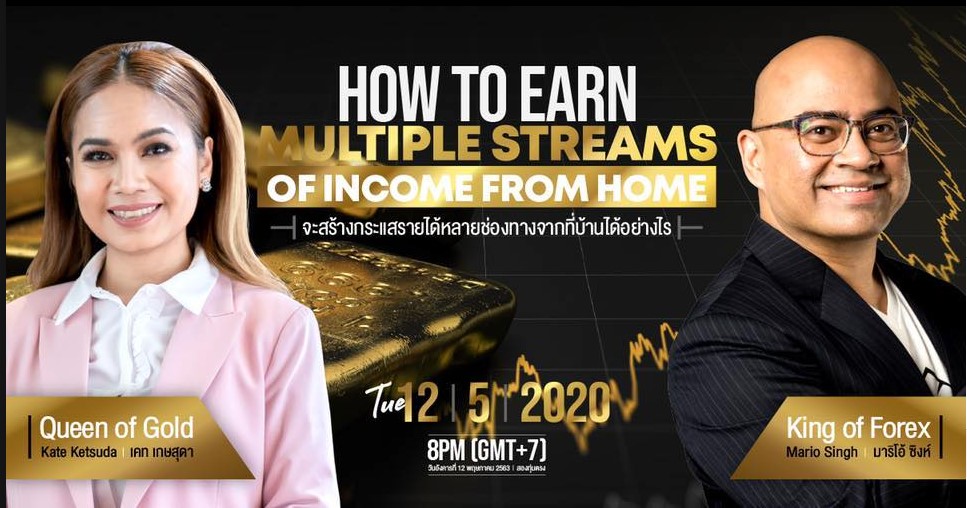

The owner of the company is Mr. Mario Sant Singh (self-acclaimed “King of Forex”). We’re sure that he has been in the Forex Industry for quite a while but to-date he doesn’t have a one-year verifiable trading history or track-record with myfxbook link. So, much for being “The King of Forex” along with being an Author, Entrepreneur as well as the Founder and CEO of Fullerton Markets. Furthermore, the onus of this broker house and all its client accusation lies on the lean shoulders of Miss Kate Ketsuda (The self-acclaimed Queen of Gold Trading) from Thailand. Sadly, again Miss Kate has not proven history or trading record. Undoubtedly, she is a great orator, marketer, and crowd puller; managed to bring several millions of dollars in deposits for Fullerton Markets.

Technical Specifications:

Fullerton Markets offers a single account type called “Standard Account” with decent leverage up to 1:500, along with variable/ floating spreads on the most widely used forex trading platform, Metatrader 4. They also offer Swap-free Sharia-compliant accounts (upon request) to clients from the Islamic faith.

The minimum deposit required by Fullerton Markets is $200, which is quite high when compared to most of the regulated brokers across the world.

Fullerton Markets offers its clients the standardized MetaTrader 4 (MT4), available in both desktop and mobile versions. However, their own customized Desktop Platform is not available.

Promotions

1. Deposit Bonus: Fullerton Markets actively offers Deposit Bonuses of upto 50% to their new clients.

2. Copy Trading App – PipProfit: Mobile based application in Partnership with Tendency ( their financial technology provider) to allow their clients to join and copy the traders of the top traders listed with Fullerton Markets. However, we recently received an email stating that they have discontinued it. Now they are re-advertising the failed service as “Copy Pip” and promoting it on their website.

3. Regular Educational Seminars in Thailand, Vietnam, and Singapore: with an aim of expanding their clientele.

4. Fullerton Foundation: The philanthropic arm of Fullerton Management and Mr. Mario Singh, is a commendable CSR effort and a new gimmick to garner free donations from people across the world effortlessly.

Methods of Payment

Fullerton Markets accept the Deposits through the following modes: Wire Transfer, Credit Card and Digital Wallets such as Skrill, Neteller, and FasaPay.

Conclusion

Fullerton Markets is a b-book STP broker that provides trading in forex and CFDs on a single account type through the popular MT4 platform under competitive terms and conditions. Here are, in a nutshell, the advantages and drawbacks in relation to this broker:

| Advantages | Disadvantages |

| NDD environment | Registered offshore |

| MT4 available + copy trading service | No web platform |

| High leverage levels | Not Regulated |

| Competitive spreads | Poor Support |